Some Known Incorrect Statements About Hard Money Atlanta

Wiki Article

The 8-Minute Rule for Hard Money Atlanta

Table of Contents5 Simple Techniques For Hard Money AtlantaThe Buzz on Hard Money AtlantaNot known Details About Hard Money Atlanta Some Of Hard Money AtlantaExcitement About Hard Money Atlanta

These tasks are generally completed swiftly, for this reason the need for fast accessibility to funds. Benefit from the project can be made use of as a down payment on the following, as a result, hard money finances allow capitalists to range and flip even more buildings per time - hard money atlanta. Considered that the dealing with to resale amount of time is short (generally less than a year), residence flippers do not need the long-term financings that typical home mortgage loan providers offer.Conventional loan providers may be thought about the antithesis of tough cash lenders. What is a hard cash lending institution?

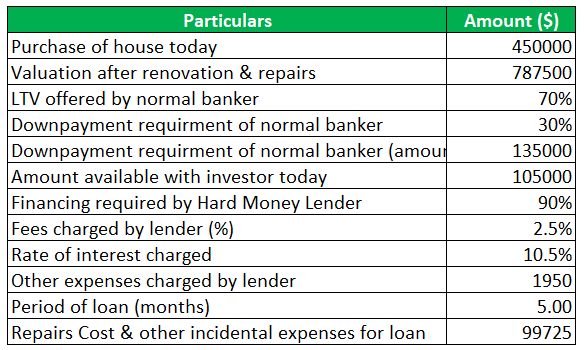

Typically, these variables are not one of the most important factor to consider for loan qualification (hard money atlanta). Instead, the value of the residential or commercial property or asset to be acquired, which would certainly additionally be utilized as collateral, is mostly taken into consideration. Rates of interest might likewise differ based upon the lending institution as well as the handle inquiry. Many lenders might charge passion prices varying from 9% to even 12% or even more.

Tough money lenders would certainly likewise bill a charge for offering the car loan, and also these charges are likewise called "points." They generally end up being anywhere from 1- 5% of the total lending amount, nonetheless, factors would generally amount to one percentage factor of the financing. The major distinction between a difficult money loan provider and also various other lenders exists in the approval procedure.

Some Of Hard Money Atlanta

A tough money lending institution, on the other hand, concentrates on the possession to be purchased as the leading consideration. Credit rating, revenue, as well as other specific requirements come second. They also vary in terms of simplicity of accessibility to funding as well as interest prices; tough cash loan providers provide moneying swiftly and also bill greater rate of interest rates.You could discover one in one of the complying with methods: A straightforward net search Request suggestions from regional realty representatives Request referrals from investor/ financier groups Because the loans are non-conforming, you should take your time reviewing the requirements and terms offered before making a computed and notified choice.

It is vital to run the numbers prior to going with a difficult cash car loan to make sure that you do not run right into any loss. Request your hard money car loan today and obtain a loan commitment in 24 hr.

A hard cash car loan is a collateral-backed lending, protected by the actual estate being purchased. The dimension of the lending is established by the estimated value of the property after proposed repair services are made.

Hard Money Atlanta Fundamentals Explained

A lot of tough cash car loans have a term of six to twelve months, although in some instances, longer terms can be prepared. The borrower makes a monthly payment to the lender, typically an interest-only payment. Below's just how a regular difficult money funding works: The customer wants to purchase a fixer-upper for $100,000.

Some loan providers will certainly call for even more money in the bargain, as well as ask for a minimum down settlement of 10-20%. It can be beneficial for the financier to seek out the lending institutions that need marginal deposit choices to minimize their cash money to shut. There will additionally be the normal title costs associated with closing a purchase.

Make certain to consult the hard cash lender to see if there are prepayment charges billed or a minimum yield they call for. Presuming you are in the lending for 3 months, as well this hyperlink as the property costs the forecasted $180,000, the financier makes an earnings of $25,000. If the residential or commercial property costs more than $180,000, the purchaser makes more money.

As a result of the shorter term and high rate of interest, there typically needs to be remodelling as well as upside equity to record, whether its a flip or rental property. A tough cash funding is excellent for a buyer who wants to deal with and turn an underestimated property within a reasonably short period of time.

Little Known Facts About Hard Money Atlanta.

It is essential to know how difficult cash loans work and also exactly how they vary from standard financings. These traditional lending institutions do not usually deal in hard money finances.

How Hard Money Atlanta can Save You Time, Stress, and Money.

When using for a hard money financing, borrowers need to confirm that they have sufficient capital to effectively obtain through an offer. (ARV) of the property that is, the approximated worth of the residential or commercial property after all renovations have been made.Report this wiki page